The Ethical Foundations Behind Islam’s Prohibition of Usury

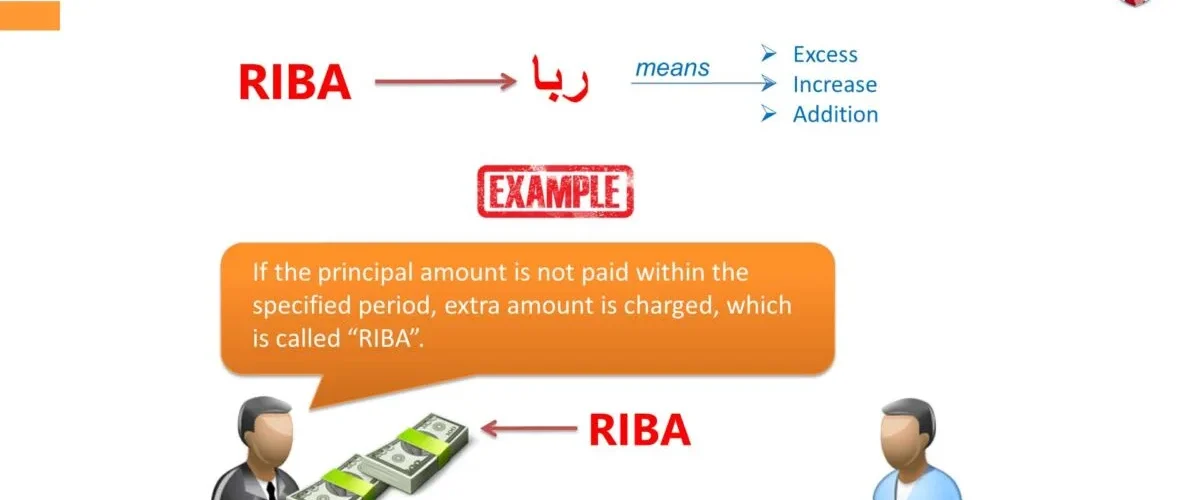

When Islam emerged in a society where financial transactions were heavily reliant on usury, the challenge was not merely to issue a religious ruling, but to confront an entrenched economic system that empowered a small elite to exploit the needs of the majority. Usury entrenched class divisions, weakened social solidarity, and turned financial need into a tool of oppression. At its core, riba involves taking excess money without a legitimate exchange—an act of clear injustice, especially when the borrower is poor and desperate, and the lender is wealthy and indifferent. Thus, the prohibition of riba in Islam was not just a legal decree, but a reformist step aimed at protecting human dignity, preserving social cohesion, and establishing an economy rooted in justice and compassion.

The reasons behind the prohibition of riba are multifaceted—ethical, social, and economic. First, it violates the principle of fairness, as it allows one party to take wealth from another without offering anything in return. Islam views wealth as a trust that must be earned through effort and exchanged fairly. Second, riba discourages productive labor. The lender profits without work, which undermines motivation for trade, craftsmanship, and industry, ultimately harming economic vitality. Third, riba erodes social relationships. Instead of fostering goodwill through benevolent lending, it breeds resentment and hostility. Fourth, it deepens inequality. The rich grow richer by charging interest, while the poor sink deeper into debt—contradicting the values of mercy and solidarity that Islam upholds. Fifth, riba is considered a grave sin, one that provokes divine warning and spiritual consequences, as clearly stated in Islamic texts.

Islam did not prohibit riba abruptly. It followed a gradual approach, similar to its handling of alcohol. Initially, it highlighted that riba yields no true blessing. Then, it condemned the practices of previous nations who engaged in usury. Later, it warned against excessive interest, and finally, it issued a decisive prohibition once the community was ready to embrace it. This progression reflects the wisdom of Islamic legislation, which reshapes reality step by step, preparing hearts and minds for meaningful change.

Beyond prohibition, Islam offered practical alternatives. It encouraged benevolent loans (qard hasan), which are among the most rewarded acts of worship. It also introduced fair financial contracts—such as trade, leasing, partnerships, and profit-sharing—that allow for legitimate gain without exploitation. These models promote real investment, mutual benefit, and economic justice. Furthermore, Islam institutionalized zakat and charitable giving, ensuring that wealth circulates and reaches those in need—without trapping them in cycles of interest-based debt.

Thus, the prohibition of riba in Islam is not merely a legal restriction; it is part of a comprehensive civilizational vision. It restores human dignity, combats exploitation, and builds an ethical economy. Islam addressed this issue with a pedagogical and realistic approach—balancing warning with gradual reform, prohibition with viable alternatives—so that change would be internalized, sustainable, and transformative.

International Journal of Research in Finance and Management – The Prohibition of Usury and Its Impact